The video game industry entered 2025 at a crossroads – experiencing record global engagement yet facing economic headwinds. With over 3 billion players worldwide and revenues of around $184 billion in 2024, gaming remains a global powerhouse. At the same time, studios are grappling with post-pandemic market corrections, waves of layoffs, and rising development costs. New technologies like generative AI, mixed reality, and cloud infrastructure are transforming how games are made and played. Players are demanding more meaningful, social, and customizable experiences. Meanwhile, studios are rethinking monetization, platform strategies, and how to balance innovation with sustainability.

Overall state of the gaming industry

- Continued growth amid correction: After a pandemic-era surge and a slight slowdown in 2023, the gaming market is rebounding. Globally, there are over 3 billion gamers and industry revenue surpassed $184 billion in 2024. Analysts forecast steady growth, and surveys show that 77% of game developers expect the industry to expand in 2025. This optimism comes as the gaming industry stabilizes from recent disruptions.

- Layoffs and caution: The past year saw frequent studio layoffs and even closures, creating a climate of caution. One in ten game developers was laid off in the last year, according to GDC’s 2025 survey. Many game companies cite restructuring and shifting markets as reasons for cuts. This contraction, while painful, has prompted developers to prioritize efficiency and “do more with less.” 60% of dev teams report focusing on extending or improving existing games over launching brand-new titles, opting for leaner teams and cautious spending.

- Resilience and strategic adjustments: Despite challenges, the gaming industry is adapting rather than crashing. Developers are balancing bold creativity with risk mitigation. Studios large and small are finding ways to survive and thrive by trimming budgets, avoiding heavy debt, and investing in scalable content like live operations. These strategies aim to weather uncertainty while positioning for the next upturn. The broadening global audience and improved funding outlook (many anticipate fewer layoffs and more capital in 2025 indicate that gaming’s core health remains strong even as it undergoes a period of adjustment.

Technology trends in gaming

Technological advancements are profoundly influencing how games are developed and experienced:

Generative AI in development

AI is everywhere in the 2025 game industry. About one in three developers now use generative AI tools in their workflow – for example, to procedurally generate art, dialogue, or level designs. AI-powered software can accelerate content creation and QA testing, helping small teams do the work of much larger ones. Investors have poured billions into game-related AI startups, and studios are building proprietary AI tools. However, this gaming trend comes with debate: some creators worry about the ethics and creative implications of AI-generated content. Companies have responded by tightening policies on AI usage. Despite mixed feelings, the rise of AI is undeniable, with a majority of devs working at companies exploring AI integrations in game development.

Cloud gaming & streaming

The continued rollout of high-speed internet and cloud infrastructure is making console-quality gaming on any device a reality. Cloud gaming services run games on remote servers, streaming the video to players – no high-end hardware is needed locally. This could be transformative in the long run: for example, Microsoft’s Xbox Cloud Gaming allows playing Xbox titles on phones and low-end PCs. The sector’s revenue is growing fast, projected to reach around $10.5 billion in 2025 and doubling again by 2029. Cloud gaming reduces barriers to entry for players (no expensive console/PC required) and enables new business models (like subscription libraries). It also ties into the broader gaming trend of content streaming (similar to Netflix for games). While latency and infrastructure challenges remain in some regions, cloud gaming’s progress in 2025 suggests it’s becoming a standard part of the ecosystem rather than a fringe idea.

Virtual reality and augmented reality

VR and AR gaming continue to advance in 2025, though their path has been tempered by reality. On one hand, VR engagement is at an all-time high among its user base – over $2 billion has been spent on Meta Quest VR content to date, with playtime up 30% year-over-year. New hardware like the Meta Quest 3 and Sony’s PSVR2 delivered technical leaps, and Apple’s entry into mixed reality with the Vision Pro has sparked fresh interest in AR. Yet overall industry enthusiasm remains cautious. A late-2024 survey found over half of game developers view the VR market as stagnant or declining, and global headset sales actually dipped ~10% in 2024. Many big studios have held off on new VR titles, citing the still-limited audience and lingering hardware issues (cost, comfort, motion sickness). In short, VR/AR is maturing with better tech and steady niche growth, but a true mainstream breakthrough is still on the horizon – likely contingent on lighter, cheaper devices and must-play content that convinces more gamers to strap in.

Blockchain and web3 experiments

A subset of game developers are experimenting with blockchain technology in games, introducing concepts like true digital ownership of in-game assets via NFTs and cryptocurrency-based economies. Especially in online competitive games and the gambling sector (iGaming), blockchain is touted to enhance security and transparency. For instance, some games allow players to buy/sell items as NFTs or reward players with crypto tokens. However, the mainstream gaming industry has been cautious after the NFT hype of 2021-2022 cooled off – many gamers voiced skepticism toward “play-to-earn” mechanics. In 2025, blockchain integration is far from widespread, but it remains a trend to watch in niche communities. If developers can find consumer-friendly uses (like truly cross-game assets or decentralized mod marketplaces), Web3 tech could still significantly impact gaming in the coming years.

Shifting monetization models

How gamers pay for games – and how game companies monetize them – is in flux. The era of one-and-done game purchases is giving way to diverse monetization approaches:

Live-service games & microtransactions

The live-service model (continually updated games with ongoing revenue streams) has become one of the biggest markets in gaming. Hits like Fortnite, Genshin Impact, and GTA Online show how a game can thrive for years post-launch through new content drops, season passes, and microtransaction sales. For game developers, the appeal is clear: a successful live-service title means a consistent player base and steady income instead of the boom-and-bust of one-off sales. In 2025, cross-platform play and cross-progression are often built into these games from the start, as developers recognize the importance of reaching the widest audience possible across PC, console, and mobile). The flip side is that the market is crowded; players only have time (and money) for so many continually updated games. Issues like content fatigue and burnout are real concerns. Studios are learning that sustaining a live-service game requires careful pacing of updates and respectful monetization – otherwise, players churn to the next big thing.

Subscriptions and all-you-can-play libraries

Building on the success of services like Xbox Game Pass, subscription models are gaining traction. Rather than buying individual games, players subscribe for a monthly fee to access a large library. Xbox Game Pass Ultimate, PlayStation Plus, and others have grown significantly, offering value-conscious gamers dozens of games on tap. This model is reshaping revenue streams: developers now negotiate deals to get their game on a service, trading direct sales for access to millions of subscribers. For consumers, it’s a great deal (many refer to Game Pass as the “Netflix of games”), though some worry about long-term impacts on game ownership and developer earnings. Still, as cloud gaming lowers hardware barriers, these subscription platforms could become the dominant way casual players consume games – a major shift from the traditional retail model.

Hybrid monetization & “free-to-play” evolution

The line between premium and free games has blurred. Many traditionally paid games now incorporate in-game purchases or DLC, while free-to-play titles aim to appear “fair” and not pay-to-win. Interestingly, over half of developers (57%) say they are working on premium (pay-upfront) games, meaning there’s still a strong market for traditional sales. But almost as many are focused on free-to-play or hybrid models. We’re seeing a growth of “hybrid-casual” games, especially on mobile – games with simple core loops that monetize through ads and optional purchases. Monetization design has become a discipline in itself, with studios carefully balancing game design with revenue needs to keep players happy and spending over time.

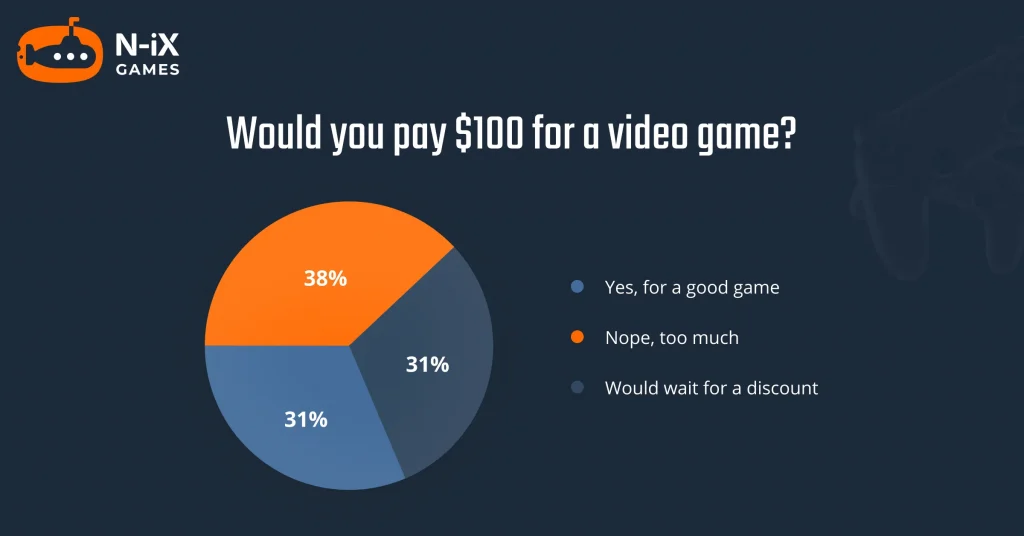

The $100 AAA game

As for the remaining one-and-done, the prospect of $100 base-priced games has become a flashpoint as the next wave of blockbusters looms. After the standard sticker price crept from $60 to $70 for this generation, some analysts and publishers are openly musing about even higher pricing for the 2025-2026 biggest titles. A notable example is Grand Theft Auto VI: industry analyst Matthew Ball noted that some game makers hope GTA 6 will launch at $80–$100, shattering the $70 ceiling and resetting market prices upward. The rationale is that game budgets are at record highs even as real prices (after inflation) have trended down. Such a hike might shrink the audience and make little business sense.

N-iX Games recently conducted a poll among our audience, revealing that only 31% of gamers are willing to pay $100 for a quality product. The remaining respondents were either hesitant or outright opposed to the idea.

Other observers point out that many AAA games already effectively charge $100 via deluxe editions and “early access” bundles, without scaring off buyers. Charging that same amount for the standard edition, though, is seen as a bridge too far. Even for a juggernaut like GTA, analysts predict severe player backlash if $100 becomes the norm. More likely is a continued tiered approach: $70 base games, with premium versions above $90 for those willing, allowing publishers to capture extra revenue while keeping the entry point accessible. In any case, the pricing debate signals how rising development costs are colliding with consumers’ expectations – a tension that will shape monetization strategies in 2025 and beyond.

Developer and publisher outlook

After a tumultuous couple of years, game developers and companies are adjusting their strategies and outlook. Surveys show 77% of game developers anticipate industry growth in 2025, and 90% of studios plan to launch at least one new game in the year. This confidence stems from the slate of new platforms and games coming, as well as the expectation that the post-pandemic slump has bottomed out. Many believe the cost-cutting and reorganizations done in 2023–24 will bear fruit in a leaner, more efficient game industry going forward.

Recovering from layoffs

The widespread layoffs have left a mark on the community. Developers report that job security is a major concern – 41% said they felt the impact of layoffs at their studio or peers’ studios in the past year. However, there is a silver lining: those cuts have forced teams to refocus on core projects, and publishers have told investors that operating costs are now streamlined for future growth. In essence, game companies trimmed fat with the hope of springboarding when game sales pick up again. The human cost is significant, though, and many game developers are banding together to support each other’s careers during this recovery phase.

Funding and investment

Access to funding has been a mixed bag. On one hand, venture capital and big publishers became more selective in 2022–2023, leaving many indie projects unfunded. Over half of developers (56%) said they’ve invested their own personal money into their projects to get them made. Traditional funding isn’t as easy to secure as it was a few years ago. On the other hand, gaming industry growth prospects are attracting investors again – some research firms recommend an overweight position on gaming stocks citing the strong 2025 lineup. We’re also seeing increased mergers and acquisitions (M&A) as larger game companies scoop up smaller studios (the Microsoft-Activision mega-deal closed in 2023, and others are following). The expectation of more funding availability in late 2025 is part of why devs are optimistic. Still, many teams are hedging by staying lean and considering alternative financing (early access sales, crowdfunding, etc.).

Platform priorities

Developers are aligning their projects with where they see the biggest opportunities. PC remains the most common platform (about 80% of devs are making a PC game), thanks to its openness and huge audience. Console development is also strong, especially with the extended lifecycle of PS5 and Xbox Series X|S and the upcoming Switch 2. Mobile games continue to be a major focus (nearly 30% of devs are building for iOS/Android), particularly in Asia and emerging markets. Interestingly, there’s a small resurgence in web browser games (around 16% of devs), possibly due to tech like HTML5 making web gaming more viable and the desire to bypass app store fees. Many studios are now “platform agnostic,” using engines like Unity or Unreal to deploy games across PC, console, and mobile with minimal friction. Cross-platform capability is seen as critical for reaching the largest audience.

Workforce and culture

The way games are made is also evolving. Remote and distributed development, which became standard during the pandemic, is here to stay – studios are hiring talent globally, not just around their offices. Unity’s report noted Latin America’s rise not only as a market but as a development hub, with talented devs contributing to global projects remotely. There’s also a growing movement for improving workplace conditions. Notably, game developers are organizing: at GDC 2025, a coalition of workers announced a new game industry union in partnership with the Communications Workers of America. This push for unionization and better labor rights is a response to the crunch culture and job instability that has long plagued the industry. Many hope that collective action will lead to more sustainable careers in game development. Overall, the talent outlook for 2025–2026 is one of empowerment – developers are gaining more tools (tech and organizational) to have a say in how games are made and how the business is run.

Indie vs. AAA gaming

The relationship and differences between indie studios and triple-A games publishers are shifting in notable ways:

“Playing it safe” at the AAA market

Big-budget game development now routinely costs tens or even hundreds of millions of dollars, which makes publishers extremely risk-averse. As a result, AAA games companies are doubling down on established franchises and sequels rather than brand-new ideas. We see this in release lineups dominated by known IP – it’s no coincidence that many of 2025’s biggest titles have a number or familiar name attached. Internal surveys reflect this cautious strategy: developers say there’s immense pressure to deliver “the next big thing,” which often means iterating on proven formulas. Even original AAA games tend to follow popular genres or video game industry trends rather than truly experimental gameplay. Additionally, many large publishers are remastering or remaking classics (e.g., Resident Evil and Silent Hills remakes, classic Mario re-releases) to capitalize on nostalgia with minimal risk. The upside is consistency and high production values; the downside can be a lack of innovation and some franchise fatigue among players.

The ongoing indie boom

On the other side, indie developers (from solo creators up to mid-size studios) continue to flourish thanks to accessible tools and distribution. Game engines like Unity and Unreal have made high-quality production achievable on a small budget, and digital distribution lets indies reach global audiences without a traditional publisher. In fact, more game developers are self-publishing than ever – over half of respondents in one survey said they’ve put their own money into their game and many are opting to self-release it. The shift to indie self-publishing is enabled by online storefronts and social media marketing; developers can keep creative control and a larger share of revenue by going this route. We’re seeing a steady stream of breakout indie hits each year (like Balatro or Dave the Diver), and subscription services often feature indie games prominently, giving them equal footing with AAA for subscribers’ attention.

Collaboration and crossover

The line between indie and AAA gaming is blurring in some respects. Many AAA studios now have smaller “indie-like” teams internally to foster creativity. At the same time, successful indie studios are scaling up and adopting some AAA practices for their next projects (GSC Game World moving from a niche first title to a more ambitious S.T.A.L.K.E.R. 2: Heart of Chornobyl, etc.). Co-development deals are also common – a big publisher might fund an indie team to make a game (as with certain Nintendo indie partnerships) which can give indies access to resources while allowing the publisher to tap into fresh ideas. According to GDC data, about one-third of devs found co-development partnerships to be very successful as a business strategy. This symbiosis means the dichotomy of indie vs AAA gaming is not as stark as it once was; the gaming industry now supports a spectrum of studio sizes.

Quality and innovation

Indie games have solidified their reputation as an innovation engine for the industry. Many new genres or gameplay ideas (battle royale, survival crafting, etc.) have roots in indie experiments before hitting the mainstream. In 2025, indies are pushing boundaries in narrative (personal storytelling winning awards), in mechanics (novel gameplay hooks that big studios wouldn’t risk), and in representation (diverse characters and themes often underrepresented in blockbusters). AAA game studios observe these trends and sometimes integrate the successful ones into their big titles. Conversely, triple-A games production techniques (like photorealistic graphics, orchestral scores) are slowly permeating into top-tier indie projects as tools improve. The result is that players now often judge games by their individual merits rather than their budget – an indie game can win Game of the Year over a AAA game, which was far less common a decade ago. The healthy competition and cross-pollination between indies and AAA gaming ultimately drive the medium forward.

Player behavior and community gaming trends

Perhaps the most important factor in the game industry is the players themselves, and their habits and expectations have evolved significantly by 2025:

Games as social spaces and self-expression

A growing number of players see video games as more than just entertainment. Multiplayer games are becoming creative and social outlets. A recent report found 46% of gamers play for the ability to create and express themselves. Whether it’s customizing characters, building worlds, or modding games, players are treating games as a canvas for personal expression. In fact, character personalization is the most popular form of self-expression in games (76% of surveyed players enjoy customizing their avatar/character). Additionally, about 39% of players use gaming as a form of social connection – hanging out with friends in-game, attending virtual concerts, or just chatting on Discord while playing. Titles like Roblox or Fortnite show how games provide tools for players to be creators and socialize, blurring the line between gamer and content creator. This trend means developers are adding more sandbox elements and social features to accommodate the creative community.

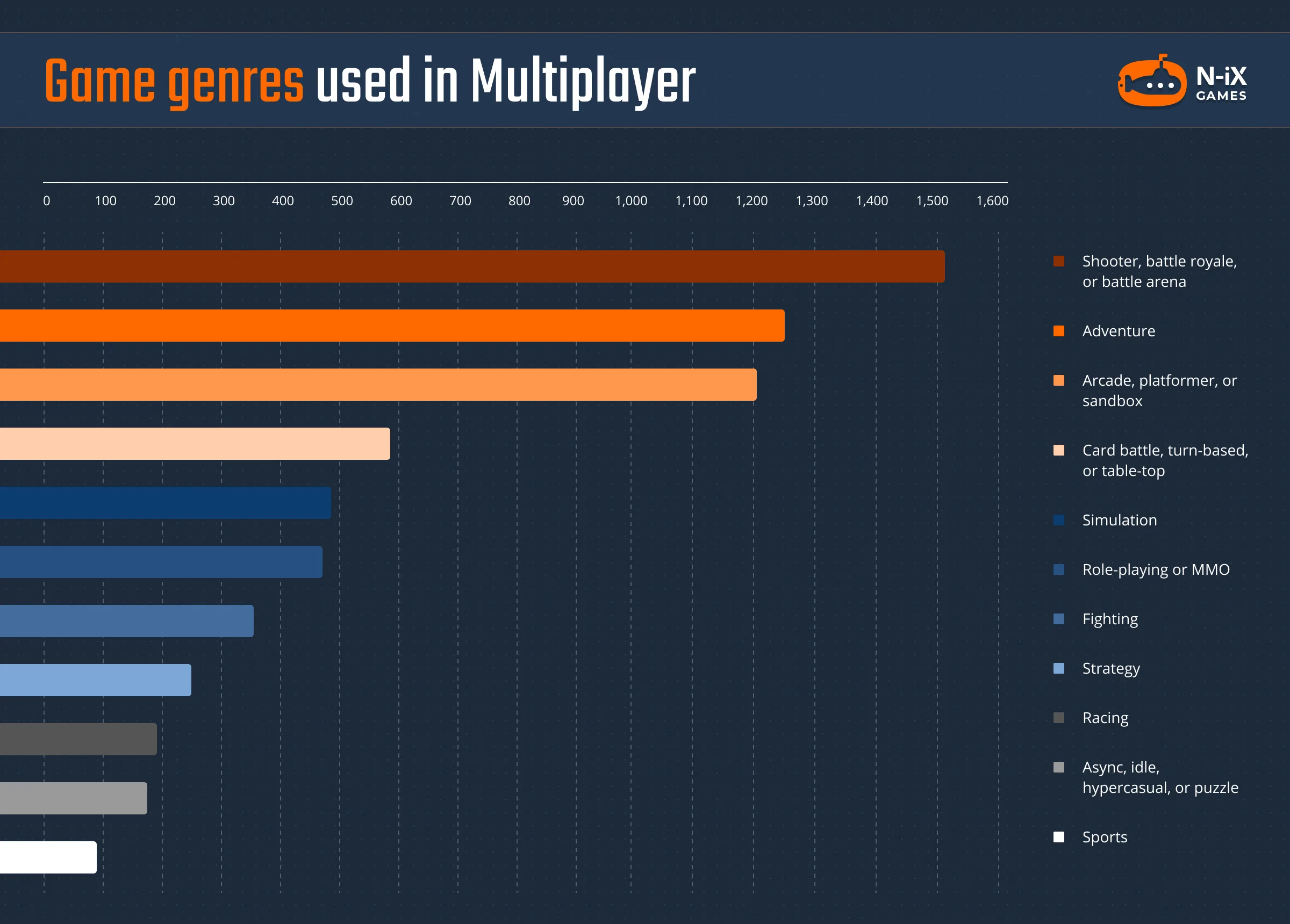

When it comes to multiplayer game genres, developers have identified strong demand for battle royales, arena shooters, arcade games, and sandbox experiences.

Diversified motivations

The player base has expanded and so have the reasons for gaming. The top reason people play is to unwind and relieve stress (54% of players) – gaming has truly become a mainstream way to relax, akin to watching TV. But players also seek challenge (33%), escapism (37%), competition (18%), and intellectual stimulation (20%) in varying degrees. This diversity in motivations has pushed the industry to diversify game offerings: from cozy “wholesome” games and meditative experiences to hardcore competitive esports, there’s something for everyone. The average gamer in 2025 is also older and more diverse than stereotypes of the past – including a nearly even gender split and a wide age range. Games are increasingly designed with broad difficulty options and accessibility settings to welcome the widest audience. In short, gaming is more inclusive and multifaceted than ever, and understanding player psychology is key for developers aiming to engage their communities.

Community-driven content

In the era of Twitch and YouTube, players aren’t just consumers but also broadcasters and community builders. Popular streamers and content creators have communities that can number in the millions, and their influence on game trends is huge. A single viral moment or endorsement from a streamer can catapult an obscure indie game to sudden fame (as seen with titles like Among Us or Valheim, or the most recent ones like Lethal Company, Chained Together, R.E.P.O.). Developers now often integrate streaming-friendly features (like spectator modes or content creation tools) to encourage this exposure. Meanwhile, official game communities (forums, subreddits, Discord servers) have become critical for player retention – players engage outside the game, discuss strategies, give feedback, and even impact development decisions. Studios are increasingly hiring community managers and doing open betas to tap into player feedback loops. The result is a more collaborative relationship: players expect to be heard, and smart developers treat their community as a partner in a game’s ongoing development.

Higher expectations for support & accessibility

Modern players have high standards for how games serve them. Cross-play functionality – the ability to play with friends on any platform – is often expected and can be a deal-breaker if absent. Gamers also demand regular updates and communication; a game that goes silent risks losing its player base quickly. Accessibility has become a major focus: gamers applaud titles that include options for various disabilities or preferences (colorblind modes, customizable controls, difficulty sliders, etc.), and regulators and advocates have pushed this forward. In recent years, many studios have made accessibility a core pillar, with efforts praised by the community and initiatives like Microsoft’s accessibility guidelines influencing design. “Making games more accessible allows more people to join in and expands the audience,” as one report noted. This not only is positive socially but also makes business sense. Diversity and inclusion efforts are similarly visible – players want to see themselves represented in games, and there’s growing support for games that tell diverse stories or feature diverse characters. All these community expectations mean the bar is higher for developers, but meeting those expectations fosters loyalty.

Esports and competitive play

The competitive scene remains a significant part of gaming culture. By 2025, esports has a mature ecosystem with franchised leagues (League of Legends, Counter-Strike 2, etc.), collegiate competitions, and huge prize pools for games like Dota 2. While not every gamer is an esports fan, the presence of esports provides aspirational goals for competitive players and a steady stream of content for spectators. Live events are returning post-pandemic, drawing tens of thousands in-person and millions more viewers online. Additionally, the idea of gaming as a spectator sport extends to streaming – Twitch and YouTube Gaming see massive viewership for both esports events and individual streamer channels. The game industry has recognized the importance of this: companies like Riot and Valve invest heavily in esports because it keeps their games relevant for years. We also see more games building competitive modes and ranked ladders to engage the competitive segment of their player base (even traditionally single-player franchises might add multiplayer components to increase longevity). Competitive gaming, whether professional or amateur, helps build passionate communities around games that can sustain them long-term.

Conclusion and outlook

In summary, the gaming industry of 2025-2026 is marked by expansion tempered with pragmatism. The overall state is one of growth – more players in more places playing more games – but also one of adaptation as companies navigate economic challenges and rapidly changing tech. We’ve highlighted how emerging technologies like AI and cloud gaming are opening new possibilities, how monetization models are shifting toward ongoing engagement, and how the perspectives of game developers, publishers, and players are all evolving. It’s a gaming industry that is simultaneously thriving and finding its footing amid change.

Looking ahead, the narrative is compelling: the games and trends on the horizon suggest that innovation will continue in step with a maturing market. From the smallest indie teams to the largest publishers, those who stay agile and keep player experience at the center are poised to succeed in this dynamic era. The next few years will undoubtedly bring surprises, but one constant remains – the worldwide love of gaming is stronger than ever, and it will continue to drive the industry to new heights.

Sources

- 2025 Unity Gaming Report

- Learn how devs are adapting to face change in the new 2025 Unity Gaming Report

- GDC 2025 State of the Game Industry

- Top Game Developer Trends Heading Into GDC 2025

- GDC Latest News

- The Past, Present, and Future of Developing VR and MR with Meta

- Three Trends Transforming The Video Game Industry

- Report: 77% of devs expect games industry to grow in 2025

- Report: Almost half of players use games as a form of self-expression

- Videogame Industry Trends 2025: Innovation, Growth, and What Comes Next

- Top iGaming Trends to Watch in 2025: Key Insights and Predictions